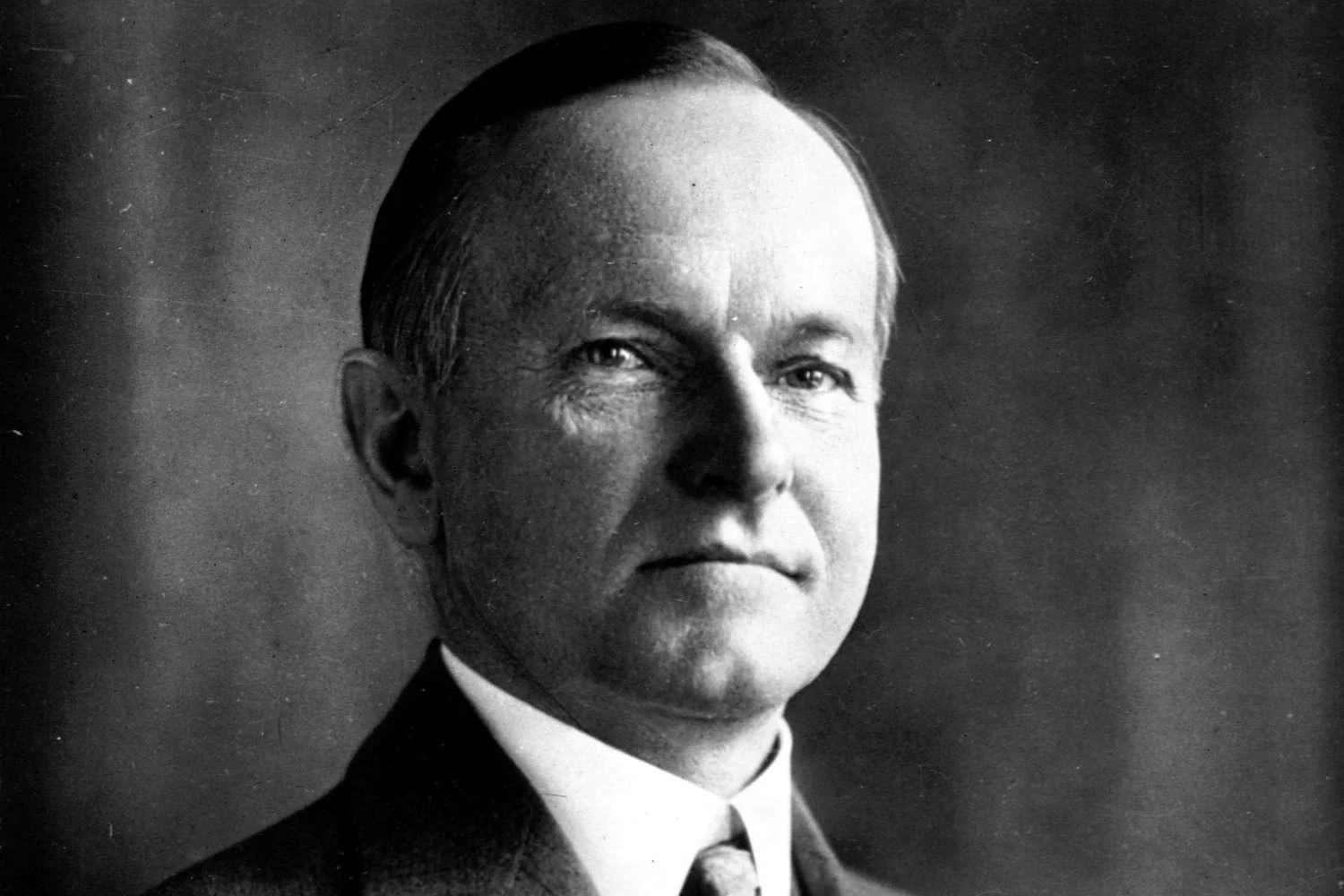

iqsafe.info – Calvin Coolidge, the 30th President of the United States, is often remembered for his quiet leadership and steadfast commitment to fiscal conservatism. Serving from 1923 to 1929, Coolidge presided over one of the most prosperous periods in American history—the “Roaring Twenties.” However, his presidency was not without its challenges. As he prepared to leave office in 1929, signs of a looming economic crisis were already beginning to appear. Though Coolidge did not live to witness the full effects of the Great Depression, his leadership in addressing the early signs of economic distress left a significant impact on the nation and shaped how future leaders would respond to economic crises.

This article explores how Coolidge navigated the early signs of economic turbulence during the late 1920s. While he was deeply committed to a philosophy of minimal government intervention, his pragmatic response to the emerging crisis showcased a nuanced understanding of the need for federal action—without abandoning his belief in limited government. Coolidge’s actions during this time, including his cautious approach to addressing the stock market boom and his policies surrounding agricultural distress, provide a window into the challenges faced by a president at the cusp of the worst economic downturn in American history.

The Roaring Twenties: Prosperity and Its Perils

When Coolidge assumed the presidency in 1923 following the sudden death of Warren G. Harding, the U.S. economy was in a period of rapid expansion. The country had recovered from the aftermath of World War I, and the 1920s saw technological advancements, a growing consumer culture, and the rise of stock market speculation. Economic growth seemed unstoppable, and many Americans embraced a sense of optimism and prosperity.

Coolidge, a fiscal conservative and firm believer in laissez-faire economics, played a significant role in fostering this period of growth. He championed tax cuts, reduced government spending, and maintained a relatively hands-off approach to business regulation. These policies were well-received, and by the mid-1920s, the U.S. economy was booming. However, beneath the surface of this economic success, cracks were beginning to appear—signs of an impending financial disaster that Coolidge and his administration would soon have to confront.

Stock Market Speculation and the Coming Crisis

One of the most significant early warning signs of the coming Great Depression was the rampant speculation in the stock market. During the 1920s, the stock market experienced a dramatic rise, fueled by widespread investor enthusiasm and the availability of easy credit. Many Americans, including middle-class individuals, began investing in stocks, often with borrowed money. The practice of buying on margin—borrowing money to purchase stocks—became increasingly common, creating an inflated sense of the stock market’s true value.

While Coolidge’s administration took a largely hands-off approach to regulating the stock market, there were growing concerns among financial experts that the market was becoming dangerously overvalued. Coolidge, who believed in minimal government intervention, was hesitant to take drastic action, fearing that any interference might harm the economy’s growth. However, he did acknowledge the potential risks posed by stock market speculation and expressed concern over the dangers of “excessive speculation.”

In 1927, the Federal Reserve took initial steps to cool down the overheated stock market by raising interest rates, which slowed the growth of stock prices. However, Coolidge, while supportive of the Fed’s actions, continued to advocate for a limited role of government in managing economic affairs. His reluctance to intervene directly in the stock market or to introduce more substantial regulatory reforms is a reflection of his broader philosophy of government minimalism.

Coolidge’s avoidance of significant regulatory reform would come to haunt the nation. By 1929, the stock market crash, which would trigger the Great Depression, was imminent. Although Coolidge did not live to see the full consequences, his tenure was marked by the early signs of speculative excess that would lead to one of the most severe economic crises in U.S. history.

Agricultural Distress: The Struggles of Farmers

Another significant challenge facing Coolidge’s administration was the worsening plight of American farmers. While urban America thrived in the 1920s, rural America faced a starkly different reality. Farmers, particularly those in the Midwest and South, were struggling with falling agricultural prices, overproduction, and growing debt. The global market, which had once been a source of demand for American agricultural products, was in decline due to global economic shifts and a post-war slowdown in Europe.

Coolidge, who had grown up in rural Vermont and understood the importance of agriculture to the American economy, was aware of the difficulties faced by farmers. However, his belief in limited government meant that he was reluctant to implement federal interventions to directly support the agricultural sector. Coolidge, like many conservatives of his time, believed that the government should not be in the business of providing subsidies or support for struggling industries.

In response to the agricultural crisis, Coolidge’s administration took steps to address the issue by reducing tariffs on agricultural goods and attempting to negotiate international trade agreements that could open up markets for U.S. farmers. However, these efforts were limited in scope and did little to reverse the downward trend in agricultural prices. By 1928, agricultural distress was one of the early signs of a broader economic downturn, with farmers in many regions unable to make a profit or service their debts.

Although Coolidge’s hands-off approach to the agricultural crisis did not provide immediate relief, it reflected his broader economic philosophy that the market, not the government, should dictate the fate of industries. However, the challenges farmers faced during Coolidge’s presidency would contribute to the mounting economic difficulties that ultimately led to the Great Depression.

The Federal Reserve and Interest Rates: Early Signs of Economic Tightening

As the 1920s progressed, the economic landscape began to show signs of strain. The Federal Reserve, under Coolidge’s watch, began to take a more active role in responding to the overheated economy. In 1927, the Federal Reserve increased interest rates in an attempt to slow down the speculative frenzy in the stock market. While Coolidge supported the Fed’s actions, he did not advocate for greater government control over the economy.

The tightening of monetary policy by the Federal Reserve, while necessary in some respects, was not enough to prevent the inevitable crash. In 1929, after Coolidge had left office, the stock market crash plunged the nation into the Great Depression. However, the Fed’s actions in the latter years of Coolidge’s presidency provided a glimpse into the difficult economic decisions that would be needed in the years to come.

Though Coolidge was not able to prevent the impending crash, his leadership and the policies enacted during his time in office helped mitigate the damage in certain sectors. The tax cuts, reduced government spending, and efforts to maintain a stable currency were essential to the relative strength of the American economy during the early 1920s, even if those policies were not sufficient to ward off the larger economic collapse that followed.

The Election of 1928: The Changing Mood of the Nation

By the time Coolidge’s term ended in 1929, the economic warning signs had become increasingly impossible to ignore. Despite the mounting evidence of economic instability, Coolidge chose not to run for re-election in 1928, opting to retire from politics. His successor, Herbert Hoover, inherited a nation that was on the cusp of a major economic collapse. Coolidge’s departure from the political stage marked a turning point, as the country would soon face its greatest economic crisis.

Although Coolidge did not directly experience the full effects of the Great Depression, the 1928 election highlighted the growing public concerns about the future of the economy. Hoover, who ran on a platform of continued prosperity, would soon be faced with the harsh reality of the stock market crash of 1929 and the subsequent economic fallout. Despite the optimism of the 1928 election, the country was rapidly heading toward a new era of hardship.

Coolidge’s Legacy: Leadership in the Face of Economic Uncertainty

Calvin Coolidge’s presidency remains a study in contrasts. While his administration presided over one of the most prosperous periods in American history, it also marked the beginning of economic difficulties that would culminate in the Great Depression. Coolidge’s belief in minimal government intervention and fiscal conservatism, while successful in fostering growth during the 1920s, would be challenged in the years following his presidency, as the nation grappled with the effects of the stock market crash and the global economic downturn.

Coolidge’s legacy, however, is not one of failure. His cautious, restrained leadership during the early signs of economic instability showed a deep commitment to his principles, even in the face of mounting pressure. While his hands-off approach to the stock market and the agricultural sector may have been inadequate to prevent the Great Depression, his commitment to fiscal discipline and limited government would continue to influence American economic policy for decades to come.

In conclusion, Calvin Coolidge’s leadership during the early signs of the Great Depression illustrates the tension between his philosophical commitment to limited government and the reality of an economy on the brink of collapse. His presidency stands as a reminder that while government intervention should be limited, there are times when even the most committed proponents of minimal government must confront economic realities. Though Coolidge did not have the tools or the political will to prevent the coming depression, his legacy as a thoughtful, principled leader endures, offering lessons in restraint, fiscal discipline, and leadership in times of crisis.